VENDOR WORKFLOWS – PART 1 – VENDOR CHANGES

This article series explains how to use vendor workflows in Dynamics 365 Finance and Operations within the context of SOX (Sarbanes-Oxley Act) compliance. Specifically, it aims to educate the audience on the SOX requirement for tracking changes in critical vendor master data, including vendor and vendor bank account information, to ensure the integrity and accuracy of financial records.

The series is divided into two parts as follows:

PART 1 - Vendor changes

PART 2 - Vendor’s bank account creation/changes

Let's get started with PART 1 - Vendor changes.

CONTENT Importance of vendor workflows for SOX Compliance Vendor workflow types in D365FO Comprehensive workflow demo for vendor changes Conclusion |

IMPORTANCE OF VENDOR WORKFLOWS FOR SOX COMPLIANCE

Ensuring SOX compliance requires strict tracking and approval processes for any changes in critical vendor master data.

SOX (Sarbanes-Oxley) compliance requires vendor master data change tracking to ensure the integrity, accuracy, and reliability of financial reporting. Here are the key reasons why this is essential:

1. Accuracy of Financial Records: Vendor master data includes critical information such as vendor names, addresses, payment terms, and banking details. Accurate vendor data is crucial for maintaining correct financial records, which directly impact financial statements and reporting.

2. Prevention of Fraud: Change tracking helps in detecting unauthorized or fraudulent changes to vendor data. For example, unauthorized modifications to payment details can lead to fraudulent payments, which can significantly impact the company's financial integrity.

3. Internal Controls and Audits: SOX emphasizes strong internal controls over financial reporting. Tracking changes to vendor master data ensures that any modifications are logged, audited, and reviewed. This enables the identification of irregularities and ensures that only authorized personnel make changes.

4. Compliance with Legal and Regulatory Requirements: SOX compliance requires companies to maintain accurate records and provide evidence of internal controls over financial processes. Change tracking of vendor data provides an audit trail that can be reviewed by internal and external auditors to ensure compliance.

5. Risk Management: By tracking changes to vendor data, companies can identify potential risks early. For instance, if there are frequent or unusual changes to vendor information, it may indicate potential issues that need to be addressed to mitigate risk.

6. Transparency and Accountability: Change tracking promotes transparency and accountability within the organization. Employees are aware that any changes they make to vendor data are recorded and can be traced back to them, which encourages responsible behavior and adherence to policies.

Overall, vendor master data change tracking is a vital component of SOX compliance, helping to ensure that financial data is accurate, secure, and reliable, thereby supporting the overall objective of enhancing corporate governance and protecting investors.

VENDOR WORKFLOW TYPES IN D365FO

When specific form fields are updated, the system generates a change proposal. The user then submits this through the workflow. Upon approval, the changes are automatically applied, requiring no additional action.

Workflows are triggered only when users update certain fields. In other words, workflows are not triggered by any type of update but only when one of the predefined field values is changed. Therefore, the fields subject to the approval process are limited as below.

Vendor’s Bank Account Creation/Changes Workflow

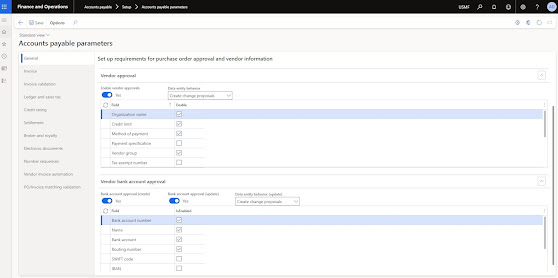

Go to Accounts payable >> Setup >> Accounts payable parameters >> Vendor bank account approval fast tab.

- Activate vendor Bank account approval on creation. (Optional)

- Activate vendor Bank account approval on update. (Optional)

- Activate vendor Bank account approval on update via data entity. (Optional)

Select the fields that are subject to approval.

Next is actual workflow configuration.

Go to Accounts payable >> Setup >> Accounts payable workflows

Configure an approval workflow.

Vendor bank account workflow will be detailed in the PART 2.

Vendor Changes Workflow

Go to Accounts payable >> Setup >> Accounts payable parameters >> Vendor approval fast tab

- Activate vendor approval process.

- Activate vendor approval on update via data entity. (Optional)

Select the fields that are subject to approval.

Note: Vendor won’t be subject to approval process on creation.

Next is actual workflow configuration.

Go to Accounts payable >> Setup >> Accounts payable workflows

Configure an approval workflow.

Note: Actual workflow configuration is not part of this article series.

You can see a fully configured and activated vendor changes workflow below.

COMPREHENSIVE WORKFLOW DEMO FOR VENDOR CHANGES

Prerequisites: Make sure that vendor changes workflow parameter is active, and fields are selected on AP parameters.

Create a new vendor.

Note that system automatically indicates that workflow approval won’t be a useful feature until a new vendor is created.

Note that vendor is created without approval requirement. There is no Proposed changes button at the top of the screen.

Let’s update Method of payment. This field is subject to approval based on the AP parameters setup.

Note that system triggers a proposed change.

You have 2 options:

Option 1: Discard the changes one by one or discard all of them.

Option 2: Close the screen and submit the workflow.

We'll go with Option 2.

Click on Workflow and Submit.

System notifies you that workflow has been submitted.

This method submits all pending proposed vendor changes to workflow.

The next step is to approve vendor’s method of payment change.

Go to Work items assigned to me form via home page as shown below.

Select the record and click on Open.

Click on Proposed changes and review the requested changes.Close the Proposed changes form.

Click on Workflow >> Approve.

Note that final approval automatically updates the field value(s).

No comments:

Post a Comment