VENDOR PREPAYMENTS IN DYNAMICS 365 FINANCE AND OPERATIONS

CONTENT Introduction Vendor prepayment reasons Vendor prepayment types in D365FO Setup requirements for vendor prepayments Demo Conclusion |

INTRODUCTION

A vendor prepayment is an advance payment made to a supplier before goods or services are received. In Dynamics 365 Finance & Operations (D365FO), vendor prepayment functionality enables businesses to streamline payment processes, mitigate financial risks, and maintain healthy relationships with suppliers.

In this article, we will explore the importance of vendor prepayments, review the necessary configurations within D365FO, and walk through a demonstration of how to process vendor prepayments. Finally, we will wrap up with some key takeaways and best practices.

Vendor Prepayments Reasons

There are several reasons why organizations utilize vendor prepayments:

- Supplier Relationship Management: Making a prepayment can build trust with suppliers and improve relationships, especially with new vendors or during periods of high demand when suppliers may require upfront payments.

- Risk Mitigation: Prepayments help mitigate financial risks, particularly when dealing with overseas suppliers or when a vendor has specific prepayment terms outlined in the contract.

- Cash Flow Management: Some businesses opt for prepayments as a way to manage cash flow effectively, locking in pricing and securing essential goods or services before price changes or supply shortages occur.

- Compliance and Contractual Requirements: Prepayments may be necessary to comply with certain contractual obligations or to meet industry-specific regulations.

By leveraging the prepayment functionality in D365FO, organizations can ensure smooth payment processing and maintain accurate financial records throughout the procurement cycle.

Vendor Prepayment Types in D365FO

Organizations can use advance payments (prepayments) in 2 different ways.

- Prepayment invoicing: This method creates a prepayment invoice that's associated with a purchase order. This method is easier for tracking prepayment sources/reasons. Prepayment invoices are frequently used in business transactions, where a vendor requests an advance deposit before fulfilling a purchase order. This is often the case for custom goods or services that require upfront payments. With the prepayment invoicing feature, you can specify a prepayment amount on the purchase order, record and process the prepayment invoice, and then apply this prepayment against the final invoice once it is issued.

- Prepayments: This method creates prepayment journal vouchers by creating journal entries and marking them as prepayment journal vouchers. For this method, you can't track which prepayments to a vendor are made against which purchase orders. However, you can mark a posted prepayment for settlement against a purchase order. In several countries and regions, accounting standards require that prepayments made to vendors or received from customers are recorded in dedicated ledger accounts rather than the general customer or vendor accounts. These prepayments are initially posted to specific prepayment accounts. Once a sales order or purchase order is processed, and the invoice is issued, the payment is applied, reversing the prepayment entries. The invoice amounts are then automatically transferred to the standard customer or vendor summary accounts.

Microsoft has has a detailed chart that compares these 2 methods:

Setup Requirements for Vendor Prepayments

A new prepayment posting profile: Since prepayment is a liability that needs to be tracked, it deserves having a separate account. The only way of reflecting this approach in D365FO is to create another posting profile for vendor prepayments.

Accounts payable >> Setup >> Accounts payable parameters

Go to Ledger and sales tax tab and select the prepayment posting profile in the 'Posting profile for payment journal with prepayment' field.

General ledger >> Journal setup >> Journal names

Everything is ready, let's make a prepayment now.

DEMO

Accounts payable >> Payments >> Vendor payment journal

Create a new header and select prepayment journal.

Go to the lines.

Select vendor, and populate the prepayment amount in the debit field.

Switch to payment tab.

Toggle the 'Prepayment journal voucher' parameter on. Note that the system automatically updates the 'Posting profile'.

When the journal is posted, generated voucher is as below.

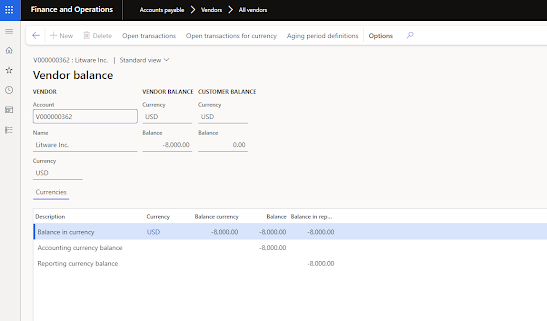

Find the vendor and click on Balance button as shown below.

Please note that the vendor balance is currently positive due to the recorded prepayment. This reflects the advance payment made to the vendor before the receipt of goods or services.

Let's assume that we got the invoice that is $10K from the vendor. It's now time to register vendor's real invoice.

Click on 'Settle transactions' as shown below.

Select the prepayment voucher.

Click OK.

Click on Yes.

Click on the Voucher button.

Note that the amount is $10,000 as expected.

Let's take a quick look at the vendor's new balance.

Note that vendor's new balance is now $8,000 as expected.

Finally let's take a look at the vendor's transactions.

CONCLUSION

Vendor prepayments in D365FO offer an efficient way to manage advance payments and meet specific procurement needs. This article demonstrated how to configure the necessary setup for prepayments and provided a walkthrough of processing prepayments via journal entries. The system’s prepayment functionality ensures accurate accounting by tracking these payments separately and automating the settlement process against vendor invoices. By following these steps, users can maintain clear financial records, reduce reconciliation efforts, and handle prepayments in compliance with local accounting standards.

No comments:

Post a Comment